Lucas Tax + Energy Consulting Cheraw Healthcare REAP Feasibility Study: Objectives, Info, & Document Request

Inbox

| randy@lucastaxandenergy.com |  Jul 27, 2016, 6:04 PM Jul 27, 2016, 6:04 PM |   | |

to me, Mark |

Matt:

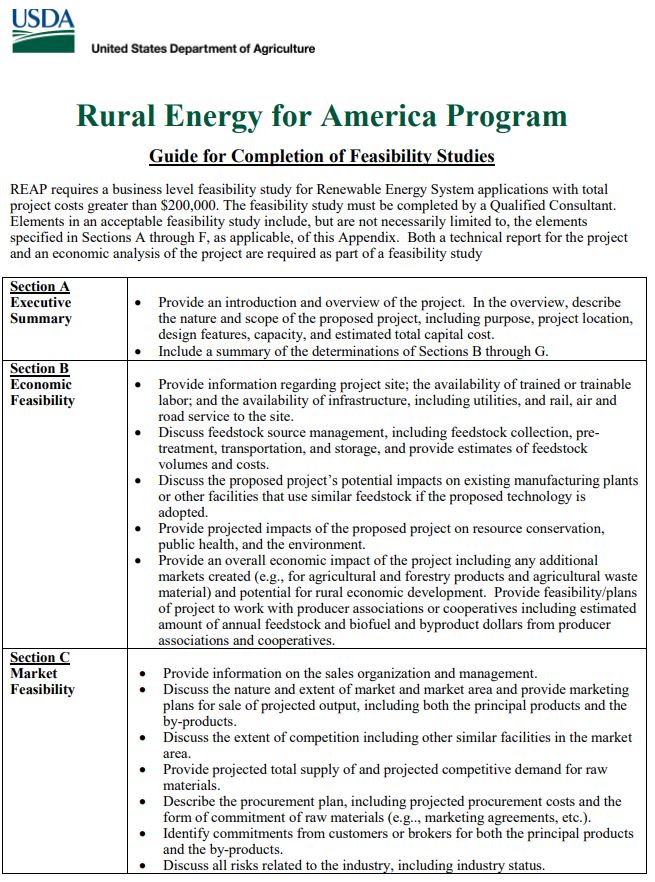

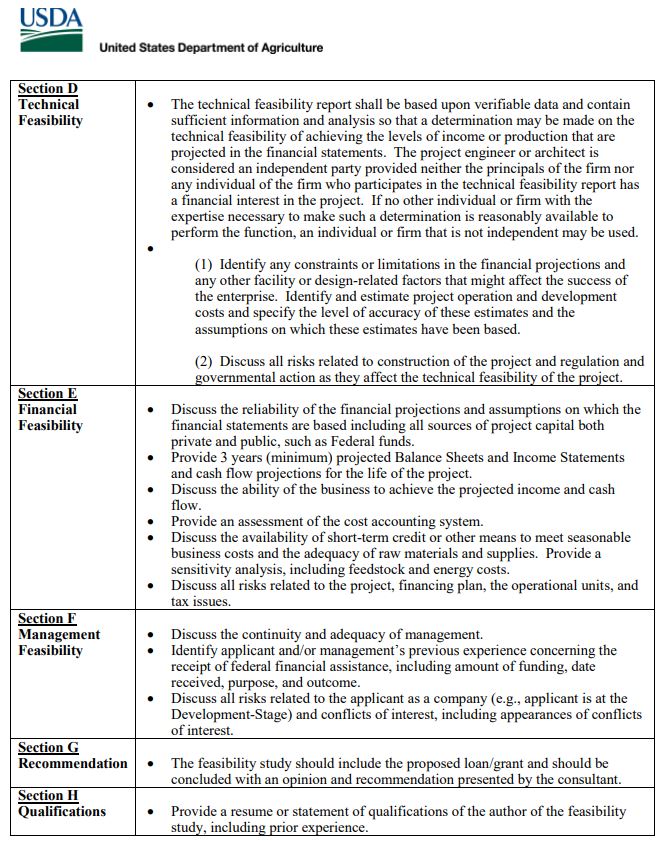

Please see the attached REAP Feasibility objectives, information, and documentation request for Cheraw Healthcare’s grant application. I have also attached the guidelines from the USDA for Feasibility Studies which outlines the content we need to include in the study.

I have noted the item we already have on the document request from your recent email in red font on page 2. Please let me know if you have any questions. If we can have the documentation on or before Aug 8th, that would be great for our schedule and process. Please let me know if there any issues or questions.

These documents will be used as appendix exhibits that will be included in the study and REAP application for the REAP grant.

ManyThanks for this this opportunity to work with you and your customer’s Cheraw Healthcare.

Kind regards and best wishes on the move into your new building,

R

Randy M. Lucas, CPA | Principal Consultant | Lucas Tax + Energy Consulting | Ph. 704.968.5506

On 2016-07-26 11:24, Matt Warren wrote:This is the project with Hannah for the REAP feasibility study. Begin forwarded message:

From: Matt Warren <matthewtwarren3@gmail.com>

Date: July 20, 2016 at 8:11:24 AM EDT

To: Joel Dyson <jdyson@cherawhc.com>

Cc: Jeff Keeney <jokeeney@gmail.com>

Subject:Cheraw Healthcare

Hi Joel, Please find attached the spreadsheet that we discussed last week. As you can see, you are cashflow positive the first year. I am working on the REAP Grant application. I know that we will need the past 3 years tax returns. Would you please point me in the right direction to get those together for you. Thanks! Looking forward to earning your business. Matt

Re: Cheraw Healthcare

Inbox

| Joel Dyson <jdyson@cherawhc.com> | Aug 5, 2016, 8:39 AM |   | |

to me |

Matt,

Can you send me one of your company brochures, etc. like you showed me when we met; I’d like to have one in hand when our board talks about your project here.

Thanks,

Joel

Joel Dyson

Administrator

Cheraw Healthcare Inc.

jdyson@cherawhc.com

On Jul 25, 2016, at 10:25 AM, Matt Warren <matthewtwarren3@gmail.com> wrote:

Great news. Thanks Joel. I will get working on the REAP grant and seeing what kind of terms we can get you from the bank.

Did you get some more info on your friends’ solar that apparently works when the power is out?

Thanks Joel

Matt Warren

Solar Power Provider

On Jul 25, 2016, at 10:07 AM, Joel Dyson <jdyson@cherawhc.com> wrote:

Matt,

Please see the attached.

Joel

Joel Dyson

Administrator

Cheraw Healthcare Inc.

jdyson@cherawhc.com

Begin forwarded message:

From: Tracy Huggins <thuggins@boscpa.com>

Subject: RE: Cheraw Healthcare

Date: July 25, 2016 at 6:49:47 AM EDT

To: Joel Dyson <jdyson@cherawhc.com>

| ShareFile Attachments | |

| Title | Size |

| Cheraw Healthcare, Inc – 2013 S-Corporation Return.PDF | 468 KB |

| Cheraw Healthcare, Inc – 2014 S-Corporation Return.PDF | 467.9 KB |

| Cheraw Healthcare, Inc- 2012 S-Corporation Return.PDF | 441.9 KB |

| Download AttachmentsTracy Huggins uses ShareFile to share documents securely. Learn More. |

Joel, We have reviewed the proposal and find all the tax credits listed to be accurate and available. The depreciation calculations also appear to be accurate. There are tax liability limits each year to claim the credit but any unused portion can be carried forward for 10 years. We don’t feel you will have any issues with tax liability limits based on recent return history. Attached are the previous three year’s returns for Cheraw HealthCare. Thanks, Tracy

From: Joel Dyson [mailto:jdyson@cherawhc.com]

Sent: Wednesday, July 20, 2016 9:21 AM

To: Tracy Huggins

Subject: Fwd: Cheraw Healthcare Tracy,

Can you take a close look at this proposal and fact check the tax and depreciation figures. Also, if everything looks good, I need to get them these tax returns but our are already in storage; do you have digital copies you can send them?

Joel

Joel Dyson

Administrator

Cheraw Healthcare Inc.

jdyson@cherawhc.com

Begin forwarded message: From: Matt Warren <matthewtwarren3@gmail.com>Subject: Cheraw HealthcareDate: July 20, 2016 at 8:11:24 AM EDTTo: Joel Dyson <jdyson@cherawhc.com>Cc: Jeff Keeney <jokeeney@gmail.com>

Hi Joel, Please find attached the spreadsheet that we discussed last week. As you can see, you are cashflow positive the first year. I am working on the REAP Grant application. I know that we will need the past 3 years tax returns. Would you please point me in the right direction to get those together for you. Thanks! Looking forward to earning your business.

Matt