By Emily Wild | July 20, 2016

By Emily Wild, SPW research assistant

What does the current U.S. solar market look like?

The U.S. solar industry now has more than 22,700 MW of cumulative solar electric capacity in operation, enough to power more than 4.6 million American homes, according to SEIA. The first half of 2015 brought more than 135,000 installations with a new project being installed about every two minutes. Since the implementation of the federal investment tax credit (ITC) in 2006, the cost to install solar has dropped by more than 73%. Since 2010, residential costs have dropped by 45%, and over the past three years the average price of a commercial PV installation has dropped by nearly 30%.

Nearly two-thirds of the market over the past few years has been represented by utility-scale solar, a trend that is likely to continue since many more projects are currently under construction. In the beginning of 2016, the United States reached 1 million solar installations and is expected to reach 2 million within the next two years. By the end of 2016, the U.S. solar industry is expected to install 14.5 GW of capacity, nearly double the capacity installed in 2015.

What are some new solar applications being developed?

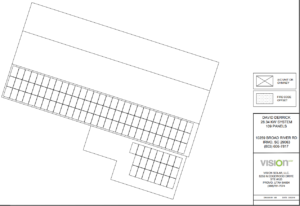

Floating solar is one of the most promising new applications being developed in the solar industry. The biggest draw for floating solar is its potential to create solar-friendly real estate from standing bodies of water. Some ideal sites for floating solar installations are wastewater ponds at water treatment facilities and chemical plants, irrigation ponds at farms or vineyards, quarry lakes or large storage reservoirs behind dams.

Not only is floating solar an optimal solution for conserving land space, but it is cost-effective compared with other energy sources since lease payments for underused bodies of water are lower than land lease payments. It also provides unique environmental benefits. Dry regions like California can benefit from the shade the panels provide because it significantly reduces the amount of water evaporation taking place. Additionally, the shade hinders photosynthesis, resulting in less algae growth on the water’s surface and improving water quality. Since the panels are naturally cooled, they exhibit improved power production.

There are currently projects in various stages of development throughout California, Arizona, Texas, New Jersey, Mexico, Brazil, France, Japan and Australia.

What are some of the main financial advantages of going solar?

With federal credits, rebates and state tax credits, the average customer only pays 50% of the total cost for a solar installation, according to EnergySage. However, net costs can vary greatly depending on what incentives are available in a specific geographic area. Solar homes will typically have free electricity for 25 to 35 years with actual savings increasing each year because upsurges in utility rates will be avoided. Customers who live in states with markets for solar renewable energy certificates (SRECs) may be able to generate additional income by selling the SRECs that the solar panel system generates back to the state.

Another area where going solar can provide financial benefits is in the overall value of the home. As long as the solar panel system is bought rather than leased, the home has the potential to sell at a premium that oftentimes pays back more than the initial cost of the system. According to a Lawrence Berkeley National Laboratory 2015 report, solar PV systems can add an average of $3.78/watt to a home sale price, which is equivalent to adding $22,680 to the cost of a home for a standard 6-kW system.

A solar panel payback period is an estimation for how long it will take customers to break even with the total cost of their solar energy investment. This calculation takes into account components including the gross cost of the solar panel system, the value of up-front financial incentives, average monthly electric use, estimated electricity generation and additional financial incentives. It is difficult to find an average payback period since many factors are considered, but the range is usually somewhere between three and 15 years. There are many online calculators available to help customers determine their specific payback period.

How does a state’s solar policy affect their solar development? How does Congress’renewal of the renewable investment tax credit affect the solar industry?

Some states, like Florida, Oklahoma, Texas, Virginia and others, maintain policies that discourage the development of distributed solar. Poor state policy can be a result of not having a renewable portfolio standard (RPS); having an RPS with a low, outdated solar target; having an inadequate statewide net metering policy; lacking strong interconnection laws; and/or having few established community solar programs. Other factors that provide barriers to distributed solar are the prohibition of third-party sales and burdensome taxes on solar and solar leasing. Florida is a state that is taking action against these codes by demonstrating efforts to remove these taxes and lower the cost of solar.

The U.S. Congress recently agreed on a bill that extends the solar investment tax credit (ITC) by five additional years. The ITC will be extended from December 31, 2016, and decreased from 30% to 10% until 2024. Projects that begin construction by 2019 will receive the current 30% ITC, while projects that begin construction in 2020 and 2021 will receive 26% and 22% respectively, according to IHS. All projects must be completed by 2024 to receive these elevated ITC rates.

As a result of the extension, the solar industry is expected to add 220,000 new jobs by 2020. It is also forecasted that clean solar energy will cut emissions by 100 million metric tons and more than $133 billion in new, private sector investments will be generated. Before the extension, the solar industry faced pressure to complete projects by the end of 2016. With the extension now in place, the number of completed projects is expected to peak in 2020 and 2023, while the extension of tax credits for residential PV enables steady growth of this segment through 2022.

Why is storage important to the growth of solar?

In the past, the majority of storage usage was in the off-grid market; however, storage is now being used to back up grid-connected projects. If PV systems are expected to replace existing energy sources, it is crucial that storage be used. GTM Research expects significant growth in the U.S. storage market over the next five years across residential, non-residential and utility markets, resulting in a 2,081 MW annual market by 2021. This is nine times the size of the 2015 market. The behind-the-meter sector is expected to account for an ever-larger share of total storage MW deployed each year through 2021, up from 15% in 2015 to 49% by 2021.

Energy storage can be deployed in most PV markets today, including residential, commercial and utility segments. It can reduce grid power usage at certain peak electricity demand times, which can help drive down customers’ electricity bills, and it can also be used to smooth system output to overcome grid integration challenges in both new solar installations and those that are retrofitted with storage.

The biggest difficulty with solar+storage remains the high cost. However, energy storage is said to be where PV was six or seven years ago, and the factors that led PV to mass affordability will have a similar effect on storage. Battery costs have already begun to decline as a result of dozens of start-up companies, new technologies and safer, more efficient types of inverters and storage options.

What is net-metering and how is it affecting solar?

During the day, most residential and commercial customers generate more electricity from solar power than they consume. Net metering allows these customers to sell their excess electricity back to the grid, which reduces their future electric bills. Even though it would generally cost electric utilities less to produce their own electricity, they are still required to buy this excess power. Depending on differences in states’ net-metering regulations, its benefits vary for solar customers in different areas of the country. Since net-metering increases the demand for solar energy systems and allows the industry to thrive, it creates thousands of jobs for installers, electricians and manufacturers. Net metering was originally developed to encourage the introduction of small-scale power sources like rooftop solar panels.

However, there is some conflict surrounding net metering. Some utilities see net-metering policies as lost revenue opportunities. When residential and commercial solar customers sell back their generated electricity to the grid, they avoid paying the utility’s power since they did not use it, but they also avoid paying for all of the fixed costs of the grid. These grid costs then take the form of higher utility bills for customers who do not have distributed energy. Edison Electric Institute is among a large population who argues that net-metering policies should be updated to reflect the decline in solar power production costs.

Sources