8/22/21 page 5 in the DA Step Study Guide

- Do you consider your behavior with money and debt to be destructive? How so? Prior to entering DA, yes, my behavior with money and debt was very destructive. It nearly cost me my marriage, my relationship with my daughter. I had maxed out every credit card I had (8-10). Banks and my parents wouldn’t loan me any more money. I had no clarity on bank accounts, savings numbers, etc. I just borrowed money to make payroll or keep the failing solar business alive…and to support my drinking and drugging habits.

- What is your earliest recollect of money and debt? What has been your experience with money and debt since then? When was the last time you debted? My earliest recollection of money and debt

- Dad loaning us $400 to buy a Toro push mower, first lesson about debt

- Most early experiences about money were good and positive. Parents were good role models for saving and working together on budgets

- I believe everything changed when I got my first few credit cards in college. They would have tables outside the library and on the walking bridge and entice students to sign up for credit cards to receive gifts and tshirts.

- Last time I debted, was when I was trying to max out that final credit card and I bought gas on it…just one last use of the credit card.

- My last break of solvency was when Meagan and I were in the Keys, last July (2020), and a powerbill that Meagan had paid before we left for the trip went through and caused us to over draft. Plus I missed one morning of doing my numbers while I was on that vacation trip and that was the day that the powerbill went through. We over drafted by something like $4.37.

- Describe the difference between a secured debt and an unsecured debt. Explore.

- Secured debt = real estate debt, car loan

- Unsecured debt = credit cards, borrowing from parents, late on bills, getting services and paying for them later

- How have you failed at managing or controlling your finances? Describe the ways in which your life is unmanageable today. Pay particular attention to how this unmanageability intersects with money, finances, earnings, and other aspects and symptoms of debting.

- I have failed at managing and controlling my finances by bouncing checks, getting insufficient funds charges, borrowed money from my daughter’s piggy bank and left her an IOU for $40, I went for 2 years without putting anything into Maddie’s college fund. Quit paying our health insurance during my bottom. Drained our emergency savings of $20,000…twice without telling my wife.

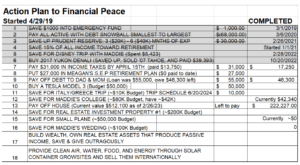

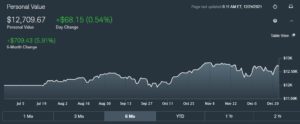

- Today, my life is not unmanageable because I have had 4 PRGs to date and been keeping my number religiously for about 3 years now. My systems are pretty well developed for tracking income, spending, debt, savings and even tracking my time and our net worth over time.

- The one are that is unmanageable is all of the debtors that I owe from the solar business and how to deal with each of them. I will have to work with my sponsor to decide what and how much to pay and on what terms to pay each of them.

- Currently I am making $72,800. Started March of 2019 at $60,000, got a raise to $70,000 after the first year. They knew that $70K was the number that I asked for in the interview. Dad knew that it would take a lot of time to get me up to speed and it was also a little test to see if I was committed. They offered me $60,000 and I took it and for that, I am forever grateful. That job allowed me to get my feet back under me so that I can stand up straight today.

- How do you describe (or define) your compulsive behavior with money? Are there other examples of compulsive behavior in your life?

- My compulsive behavior with money today is that I will spend and spend with our daughter. I have a hard time telling her no. Part of that is people pleasing and the other part is buying her love. I want her to like me and love me.

- Other examples of compulsive behaviors in my life have been drastically reduced. I used to drink, drug, act out sexually, eat whatever I wanted, whenever I wanted it. I had on routine or top lines in my life. Today, I am consistent about doing top lines and staying clear of bottom-line behaviors. That didn’t happen overnight, but since 2017 when I surrendered my life to a higher power.

- Do you feel that compulsive debting has limited your choices or opportunities in life? If so, can you list specific examples?

- No, I don’t feel it has limited my choices and opportunities in life. I feel that I am young, and they all happened for a reason. I have plenty of time to meet my dreams and goals in life so long as I stay close to the three programs that I am actively working daily, DA, AA & SLAA.

- Are you powerless over debting? If so, how? What does powerlessness mean to you?

- Yes, I am powerless over unsecured debt. I’ll take all they will give me. Just like I’ll drink and drug the whole amount without any ability to stop once I have started. I am powerless over even the most basic personal credit card. It took about 6 months for me to actually carry a credit card for my dad’s company because of the fear and sweaty palms that I would get of the idea of compulsively convincing myself that I needed to buy something. My convictions would be so intense that I had to have that item or service that I just decided to keep the credit card in my desk drawer until I would travel and need it. I have also tried putting it all on my personal debit card and getting reimbursed but that process was actually debting myself and my family of our cash. It would take 2 weeks to a month to get reimbursed from the company and that stopped that idea.

- Powerless means that I am unable to stop the behavior once I stop. I have an adverse reaction to the substance or activity. The addiction gets progressively worse too.

- What prompted you to enter the rooms of D.A.? Describe the “bottom” you experiences that made you willing to recover in D.A.

- My bottom was one Sunday afternoon when I broke down crying because I had to keep my two Hispanic workers busy the next week. I had maxed out all credit options. Late on all bank loans. Stress at home with wife was through the roof. I had drained our savings, cashed out my retirement $30,000. Dad helped me add up the debt and everyone that I owed, not including our house, and it came to $330,000. The IRS wanted to audit my 2017 taxes too. I was living a double life. We had a Range Rover but couldn’t pay to keep it maintained. I had used the cash from the sale of my wife’s Honda to fund payroll for the solar business another Friday. I had a Nissan NV3000 van that I had gotten on credit for the company, signed personally, that was about to be repo’d. I had no idea it was that the debt was that high. I had no idea how it bad it had gotten. I surrendered and got help. I was able to save from having to file bankruptcy this time but lost my credit, which is totally fine. I have my wife, family, good job and don’t need my credit score today.

- The only requirement to me a member of DA is a desire to stop incurring unsecured debt. Do you have that desire now? What does being a debtor mean to you?

- Yes, I don’t want any more unsecured debt. My wife and I have a vision of the future where we own real estate rentals, maybe several multifamily homes for passive income, but I’d like to try that with cash. I have not ruled out the idea of borrowing on those properties and using cash as a down payment, but that is secured debt. Being a debtor means that I owe people.

- Do you consider yourself a compulsive debtor? Are you an underearner or a compulsive spender, or both? Do you identify with any other types of financial dysfunction such as deprivation, pauperism, or grandiose spending?

- No, not today. I think I was a compulsive debtor, but I stopped that behavior. I think that I am an underearner and a compulsive spender, yes.

- I might have grandiose spending or thinking tendencies.

- Yes, I can deprive myself of quality suits and clothes for work. Been struggling with buying a new suit. I’m still wearing ones from my college days from when I graduated Clemson and got my first job selling Priority Management training. I bought three Joseph A Banks suits on a buy three for the price of one special.