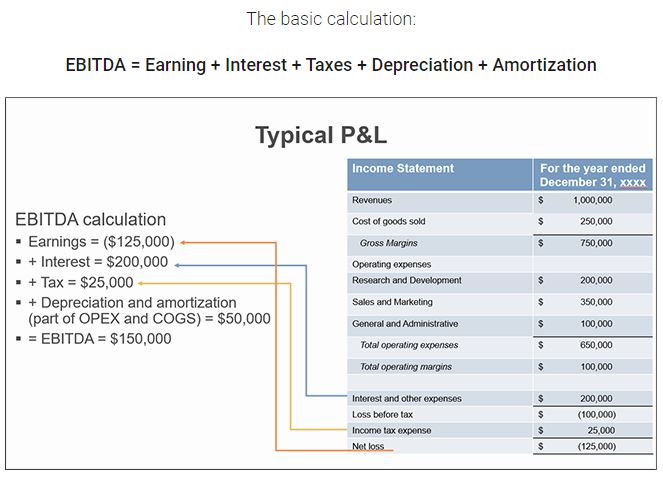

Earnings before interest, taxes, depreciation and amortization

A company‘s earnings before interest, taxes, depreciation, and amortization (commonly abbreviated EBITDA,[1] pronounced /iːbɪtˈdɑː/,[2] /əˈbɪtdɑː/,[3] or /ˈɛbɪtdɑː/[4]) is a measure of a company’s profitability of the operating business only, thus before any effects of interest, taxes and costs required to maintain its asset base. It is derived by subtracting from revenues all costs of the operating business (e.g. wages, costs of raw materials, services …) but not depreciation, amortisation, interest, lease expenses, and taxes.

Though often shown on an income statement, it is not considered part of the Generally Accepted Accounting Principles (GAAP) by the SEC[5] and the SEC hence requires that companies registering securities with it (and when filing its periodic reports) reconcile EBITDA to net income.[6]

https://en.wikipedia.org/wiki/Earnings_before_interest,_taxes,_depreciation_and_amortization

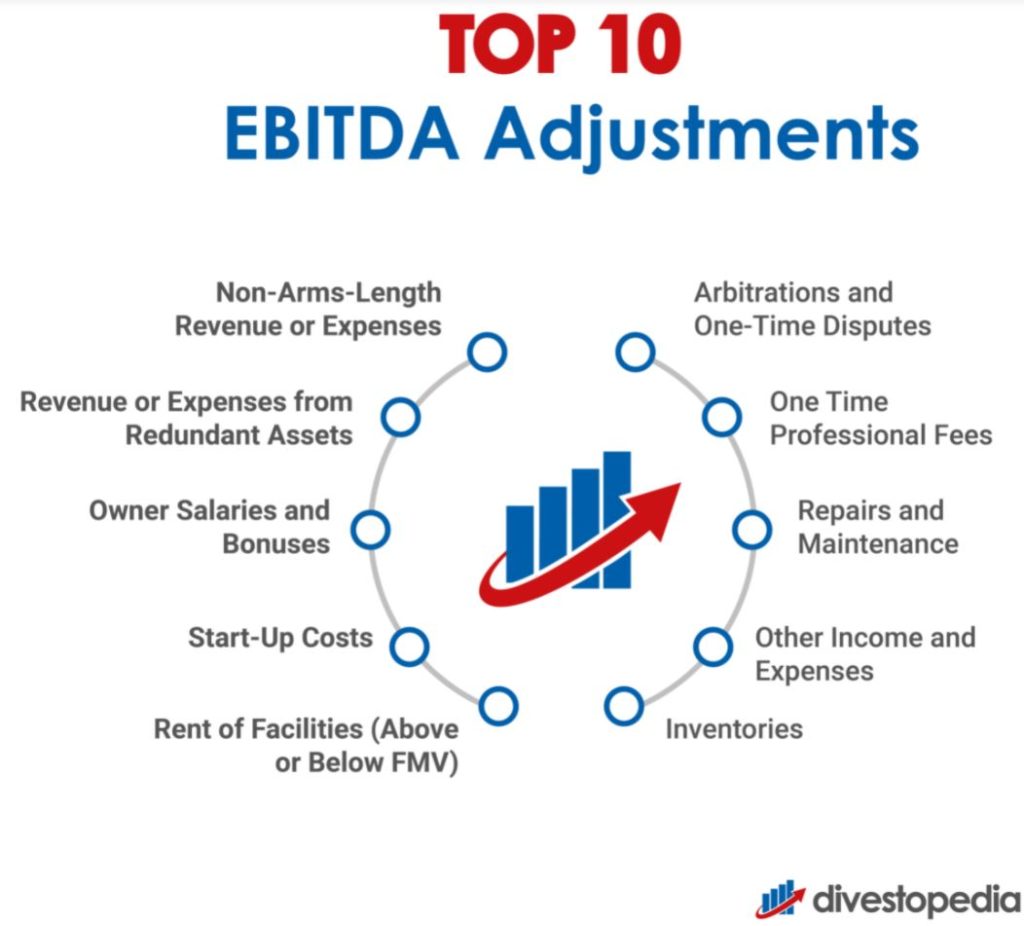

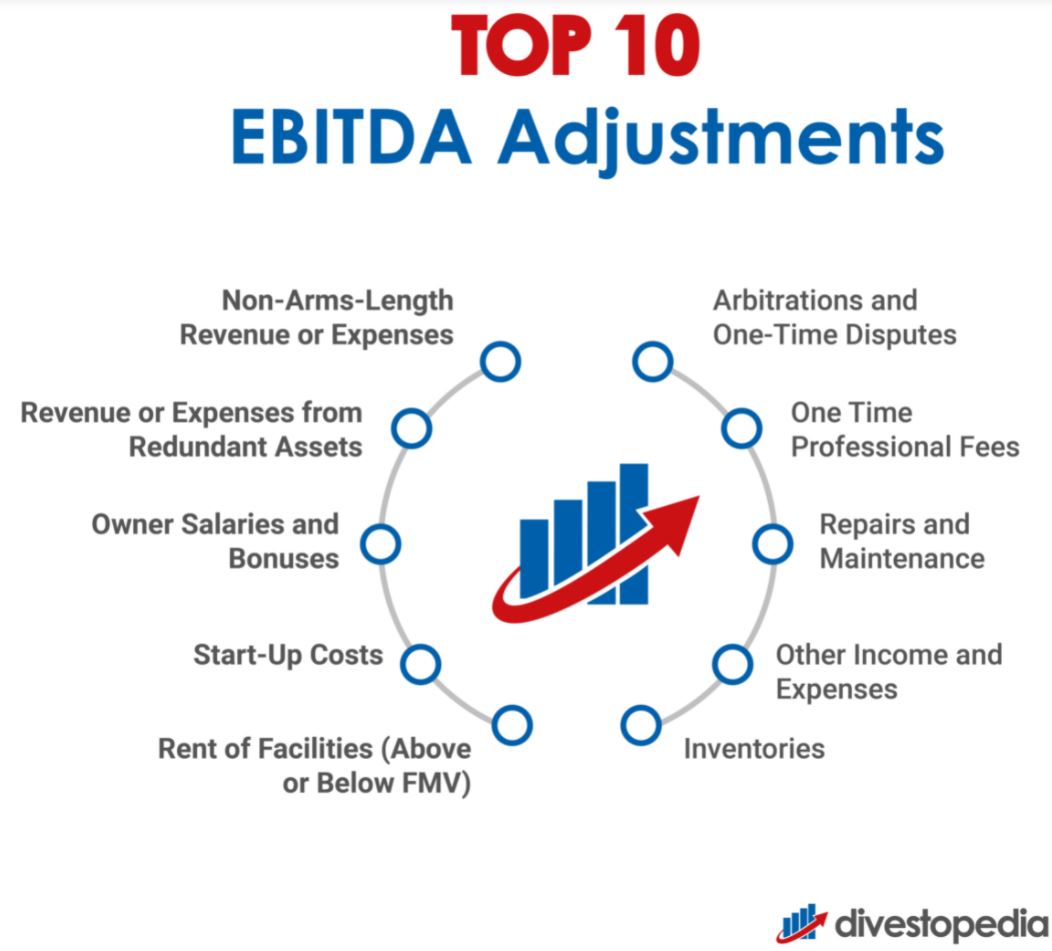

EBITDA is widely used when assessing the performance of a company. EBITDA is useful to assess the underlying profitability of the operating businesses alone, i.e. how much profit the business generates by providing the services, selling the goods etc. in the given time period. This type of analysis is useful to get a view of the profitability of the operating business alone, as the cost items ignored in the EBITDA computation are largely independent from the operating business: The interest payments depend on the financing structure of the company, the tax payments on the relevant jurisdictions as well as the interest payments, the depreciation on the asset base and depreciation policy chosen and the amortisation on takeover history with its effect on goodwill among others. EBITDA is widely used to measure the valuation of private and public companies (e.g. saying that a certain company trades at x times EBITDA, meaning that the company value as expressed through its stock price equates to x times its EBITDA).