| susi wolfson <susan@warrensolar.com> | Tue, Sep 20, 2016, 8:36 AM |   | |

to randy@lucastaxandenergy.com, me |

Randy, We are working with manufactures who are tax exempt on their electricity they purchase; my question is ” if they install a solar system do they have to pay sales tax on said system”?

Thanks so much,

Susi

Inbox

| randy@lucastaxandenergy.com |  Mon, Sep 19, 2016, 5:20 PM Mon, Sep 19, 2016, 5:20 PM |   | |

to susi, me |

Susi and Matt:

As requested, please see the attached rulings regarding South Carolina sales tax exemptions. Here is a brief summary:

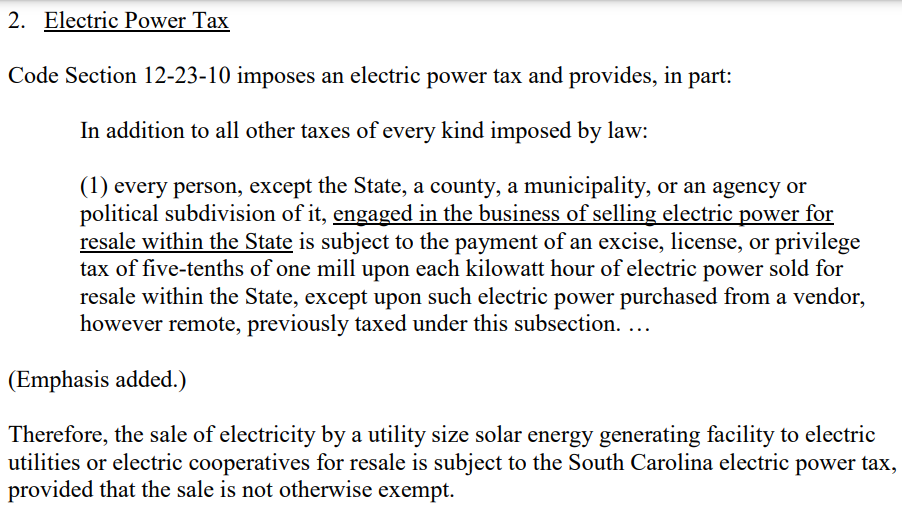

Rev Rul 15-14: Concludes that the solar energy generating facility is exempt from S&U Taxes but is subject to SC Electric Power Taxes provided the sale to the utliity is not otherwise exempt. I am still investigating…Rev Rul 10-10 also discusses the Electric Power Tax (see pg 8 of 9), and it appears that the exemption for the generation or electricity by a taxpayer in SC for use of the electricy on their own facility.

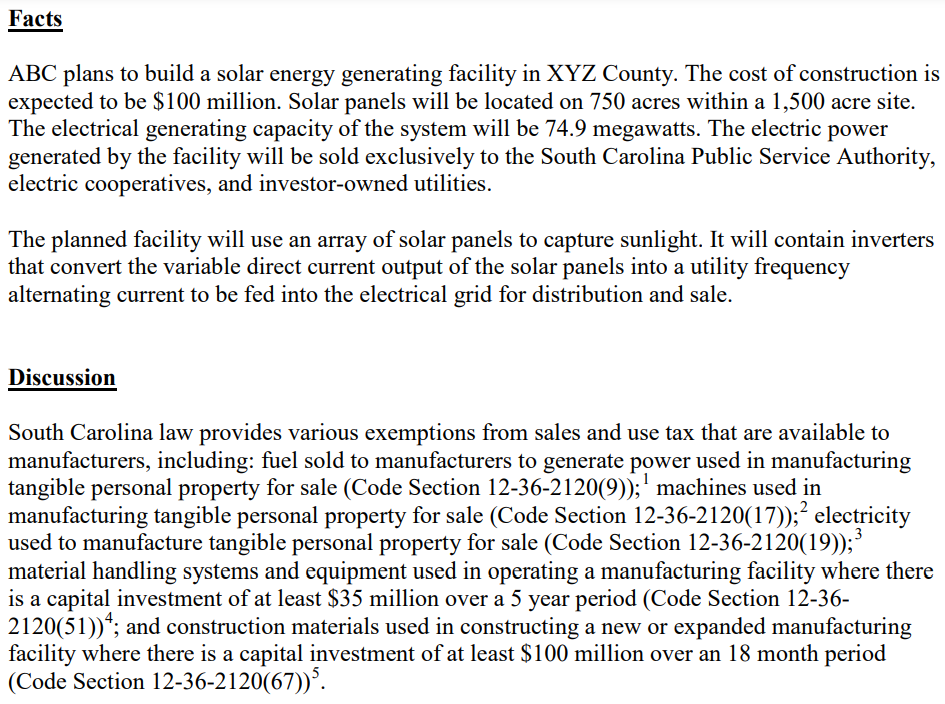

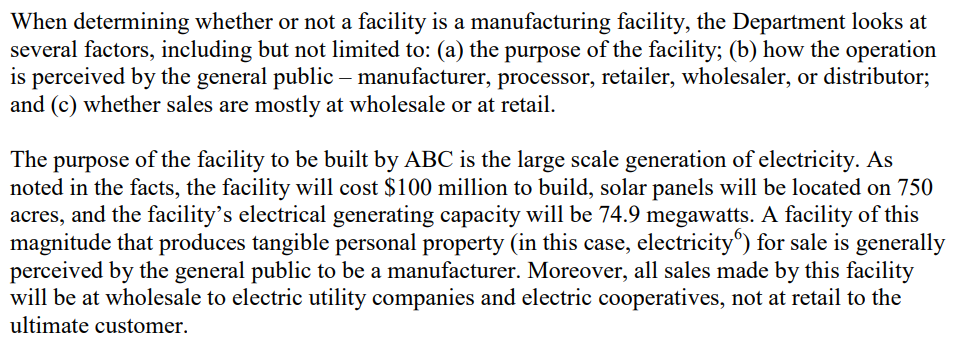

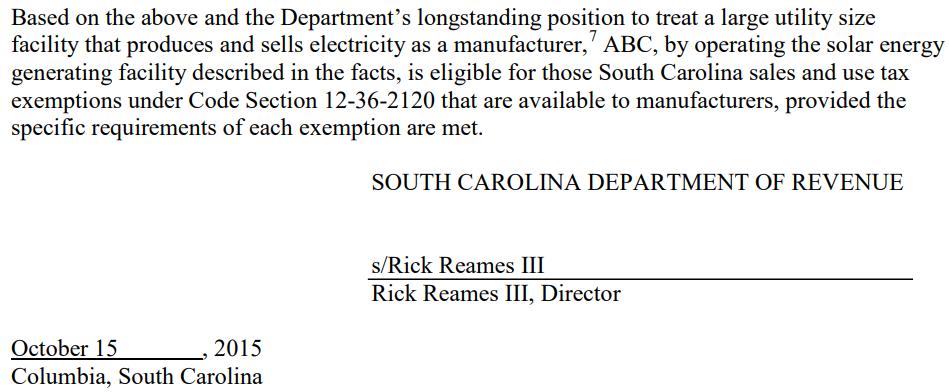

Priv Ltr Rul 15-1: Concludes large scale (74.9 MW) solar farm is exempt from S&U Taxes. No mention of Electric Power Tax.

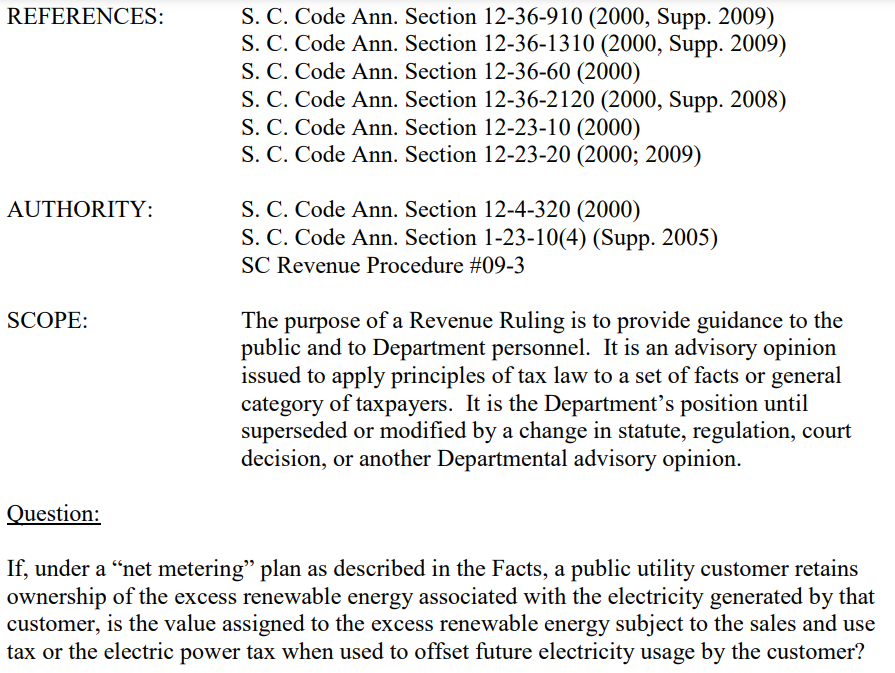

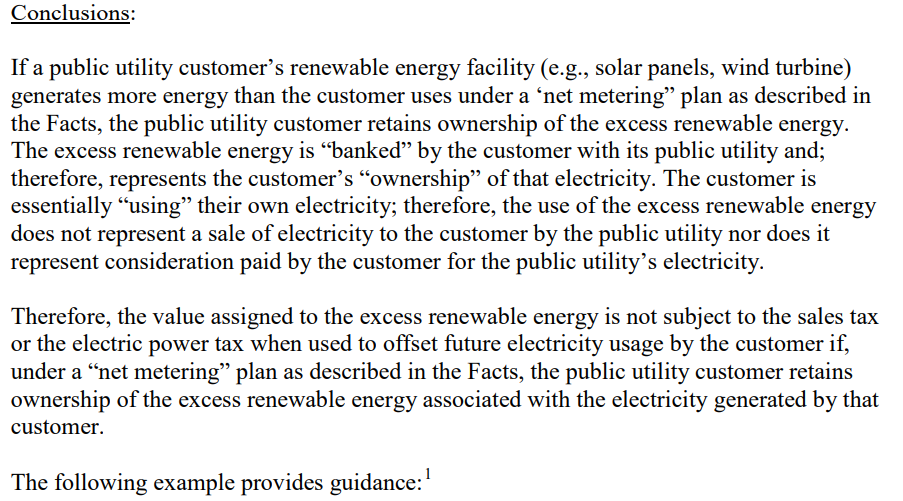

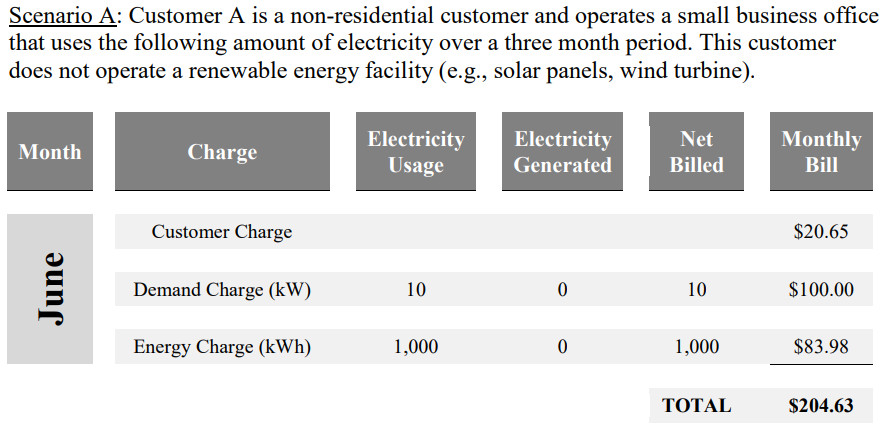

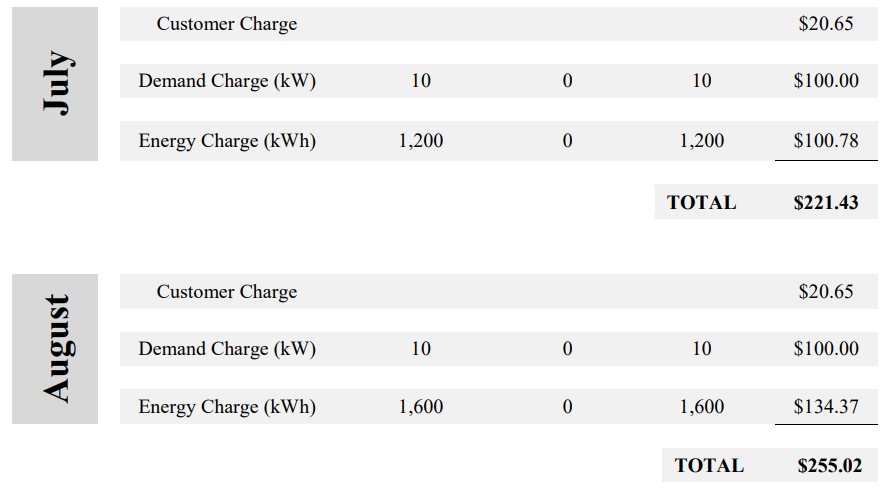

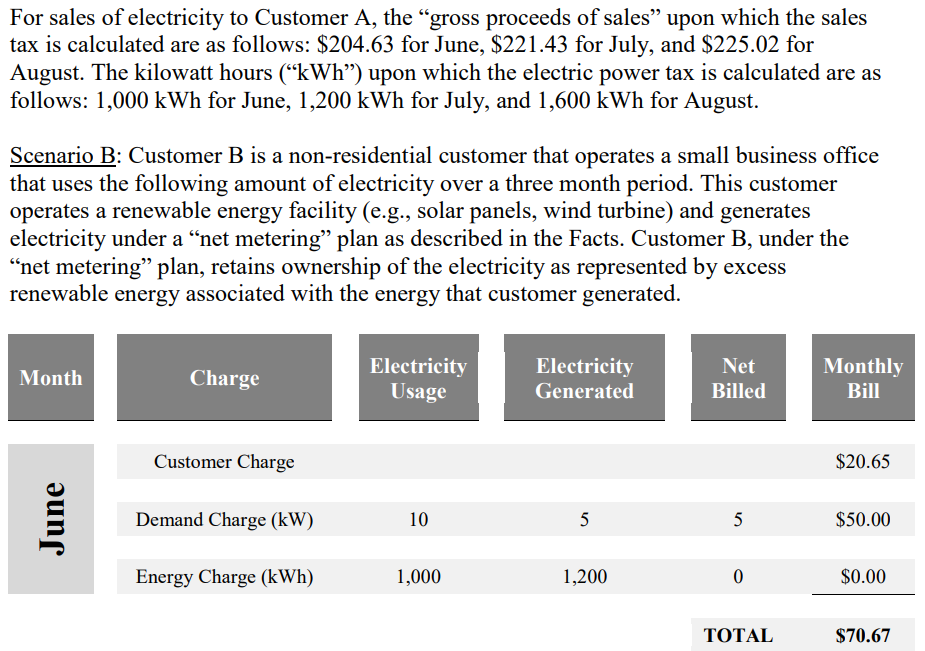

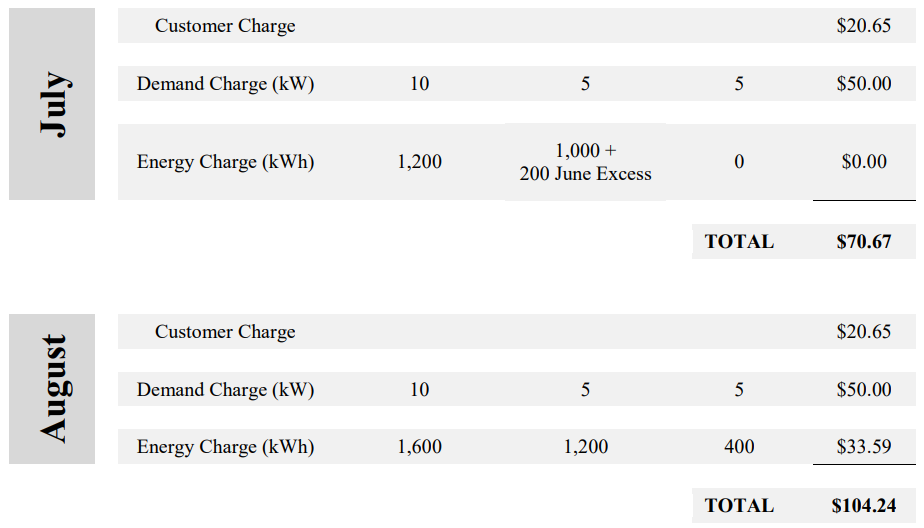

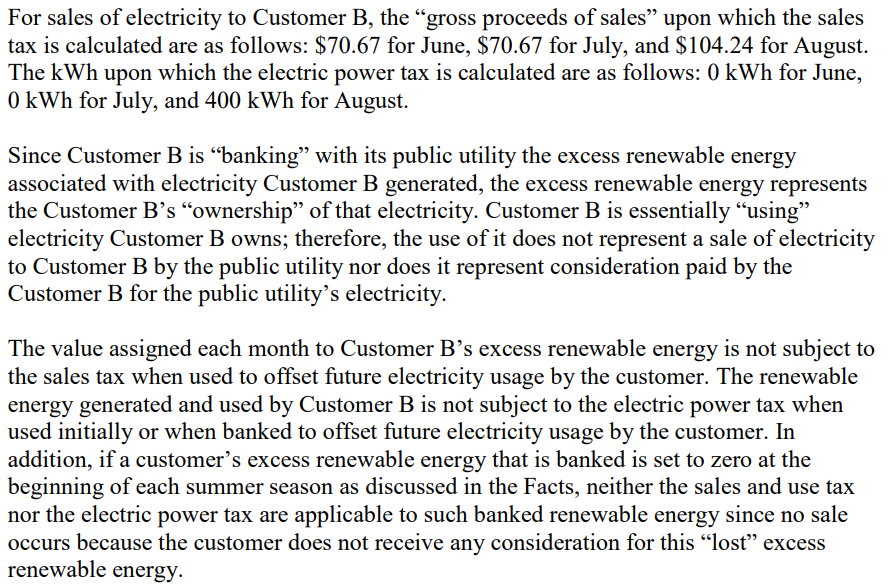

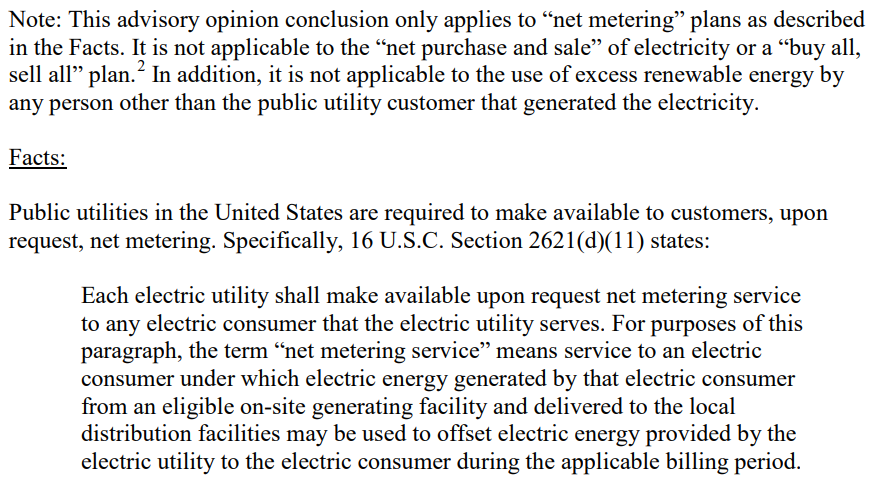

Rev Rul 10-10: Concludes that the excess electricity from a net-metering system transferred to the grid is not subject to S&U Taxes. This ruling states on Pg 9 that is does not apply to net purchase and sale project or by all sell all purchase plans.

Please review and let’s discuss any questions you may have.

Thanks,

R

Randy M. Lucas, CPA | Principal Consultant | Lucas Tax + Energy Consulting | Ph. 704.968.5506