How do we deal with creditors?

How much can I afford to pay?

How is debt payment calculated for each creditor?

The Debt Snowball vs. The Proportional method

There are multiple ways to pay down debt. These are just two methods that I know work. Before debt repayment is even an option though, I needed to make sure that my income plan and spending plan were in sound order. I was told that old debting behavior was to just pull a number out of the sky and throw it at the debt. The new way in recovery to pay down debt was to first establish an income plan and spending plan with a sponsor and a Pressure Relief Group (PRG). With historical data from keeping my numbers for several months, I was then able to determine how much I could afford to put toward the mountain of debt.

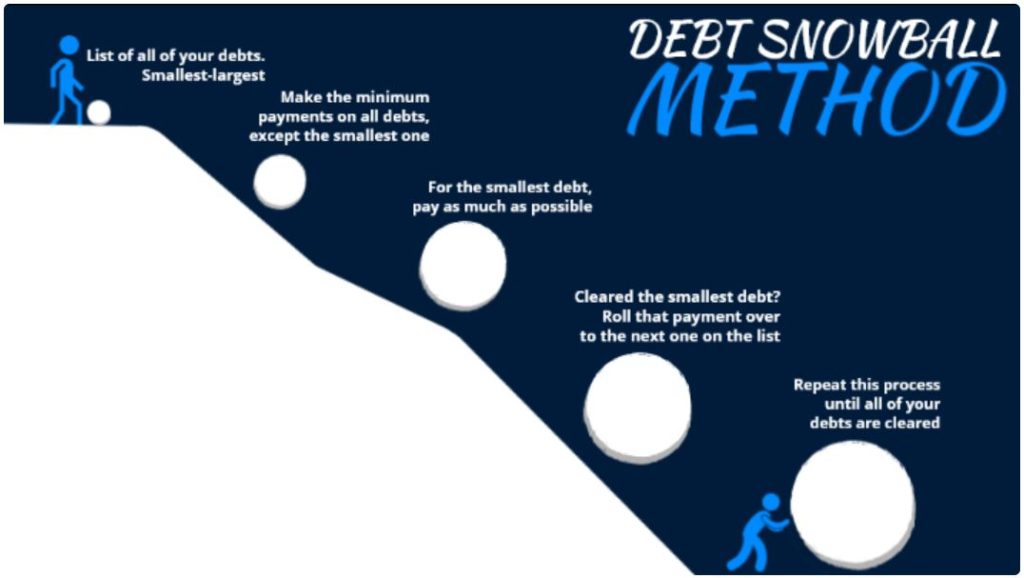

This was the method that my wife and I used to pay down $68,000 in debt in 15 months after we cut up the cards and closed all the accounts. The debt snowball is where we list the debt in order from smallest to largest. We make minimum payments on all the accounts but any extra cash at the end of the month gets used towards paying down the smallest amount first. Once the smallest debt amount is paid down, we continue to pay the monthly on all the other debts. With the first debt out of the way, we now can put the amounts that were paying towards that first debt and put it towards the second smallest debt.

So for easy math:

Creditor A we owe $1000 with minimum payment of $100 per month due

Creditor B we owe $2000 with minimum payment of $200 per month due

Creditor C we owe $3000 with minimum payment of $300 per month due

Creditor D we owe $4000 with minimum payment of $400 per month due

All creditors will get their minimums each month. When Creditor A gets paid off and is out of the way, that $100 per month that we were paying for Creditor A’s minimum balance can now be applied toward Creditor B. This creates a snowball effect. We start paying down larger and larger amounts of debt as we gain momentum. There is a true phycological effect that happens as we gain traction. Momentum is created by the sense of accomplishment as we cleaned up the smallest debts first. We just repeated this process until all debts were cleared up. Again, the key is to know how much money can be put toward the debt each month. Its important to note that before we began this process, we accumulated $1000 emergency fund first. This was important because without any more credit cards, we needed a prudent reserve to cover any unexpected bills or expenses.

The Proportional method

In general, it is best to treat creditors equally rather than give special attention to those who harass us more. This approach is to pay them proportionally, meaning each creditor represents a certain percentage of our overall debt, and we pay each a proportional amount of our debt-payment funds. This method is different than the Debt Snowball and I didn’t know about it at the time my partner and I started paying down our debt. Let me try explaining it using the same figures as the last example:

Creditor A owe $1000

Creditor B owe $2000

Creditor C owe $3000

Creditor D owe $4000

Total Debt: $10,000

We distribute a percentage to each of these debts based on what percentage they are of the total debt.

Creditor A owe $1000 = 10%

Creditor B owe $2000 = 20%

Creditor C owe $3000 = 30%

Creditor D owe $4000 = 40%

Total Debt = 100%

When we do our numbers for several months and we have true data for our income and expenses, we can take averages of those months. We will be able to get a number that is the average total income per month as well as an average total expenses number per month.

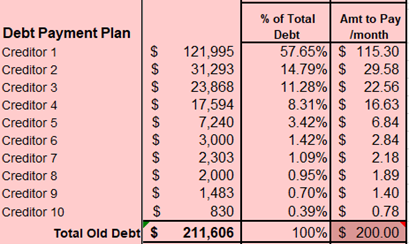

I was told to take income minus expenses per month and that will let me know how much I can put toward my debt repayment plan. At the time that I did my numbers, I only had $200 left at the end of the month to put toward the debt. I was told to distribute the $200 based on the percentage that the debt was to the entire debt owed.

Creditor A owe $1000 = 10% = $20

Creditor B owe $2000 = 20% = $40

Creditor C owe $3000 = 30% = $60

Creditor D owe $4000 = 40% = $80

Total Debt = 100%

=> total paid toward debt =$200

One thing I learned is that the proportions might be so small that it makes sense to just say I’ll pay a minimum of $10 per month to the smaller debts. It’s impractical to pay $1.40 or $.78 to a creditor. It’s the principal that counts here. A sponsor and PRG can help with this.

Here is a real-world example of what the spreadsheet might look like with formulas working behind the scenes:

Analysis of the two methods

One key take away is that both methods ignore the interest rate AND both make progress each month toward ALL the creditors. If small payments are made to each of them on a monthly, that will at least help to stop the annoying and shameful phone calls and slow down the pursuit of legal action.

The proportional method is more of a steady, slower approach but focuses on not harming ourselves or others by committing to pay creditors too much. I caught myself getting excited with the debt snowball and wanting to throw larger and larger amounts of money at the debt to wipe it out. That is a good thing, but we must really be careful to not pay too much and then run out of money…causing us to have to debt once again.

The proportional method does focus on committing to a set amount of money that can be paid each month, like the example above where we agreed to pay $200 each month divided proportionally over the four debts. That is much more steady, stable, and balanced and might work better for some people.

Final Thoughts

Note: a different approach may be necessary when a creditor is threatening or taking legal action.

One key suggestion is to make regular payments instead of making a larger payment one month and no payment the next.

Also, develop a specific date per month and stick to that schedule. If the creditor does not specify when you are to pay, then pick a date and stick to that schedule.

“Consistency takes the drama out of repayment by making it a routine part of our lives.”

– From the DA Debt Repayment pamphlet

Incase you missed last week’s newsletter on what to do to set up your spreadsheet for a new month, find it here:

Incase you missed the week before that:

Hope you have a wonderful week and remember….as mama always says, “Make your contribution!”

Matt Warren