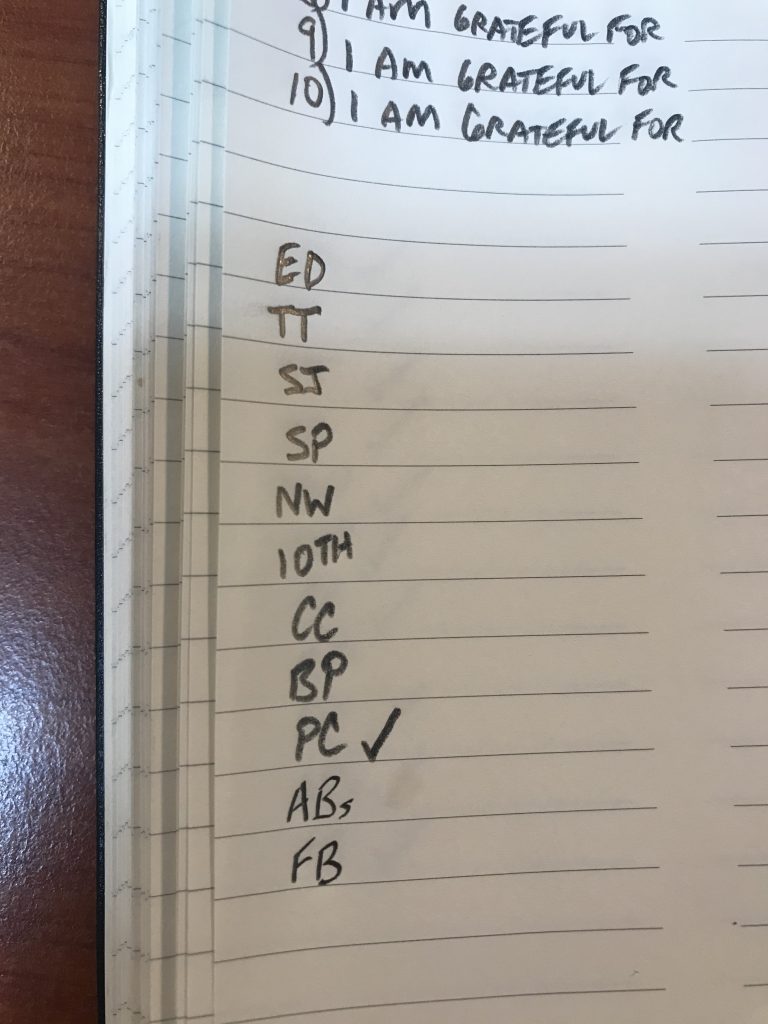

This is a snapshot of my daily Bookend 0’s. Check out my podcast episode 39 where I talk through each of these.

ED- Everydollar App. This app for my iPhone is something that I use on a daily basis now. Dave Ramsey and his team have made this so easy to use. It is being said that this is the most user friendly app available for family budgeting and I believe it. It allows us to put in how much money we want to spend in a category for the start of each month, then as we spend in that category, it shares how much money we have left. It also allows us to see what percentage of expenses are being spend as they relate to the whole amount available to spend. Like, for example, saying we spent 8% on transportation expenses, and 25% on housing.

TT- Time Tracking. My 24 hour day is accounted for in my main financial spreadsheet. This is covered in a previous blog post and podcast. Once I alot for my last 24 hours within the main categories like “work”, “driving”, “self care”, “fun”, etc…I check this off.

SJ- Spending Journal. When I am looking at the online banking website each morning, I look at the date of the expense and write what was spend under my “daily income” section on my journal. This is done on the right hand side, under the daily networth.

SP- Spending Plan. After I have the expenses written down on each day’s journal page, I then go to my spreadsheet and make sure the journal entries coorispond with the column of the day in the worksheet. I check of SP once the spending plan is updated in the spreadsheet for the previous day.

NW- Networth. Once I have all of the numbers spent written down and on the spreadsheet, at the very bottom of the column, the last cell is for the current account balance. I look at the online banking website, and write in that cell what the balance is for that moment. Then, I go over to the Personal Financial Statement tab and update the cell under bank accounts to “pull” from the spending plan worksheet account balance. This way, the personal financial statement is reading as the exact (as possible) net worth for that moment. Remember, Networth is Assets minus Liabilities. I then write at the very top right of my journal, our family’s current net worth for that day. This does fluctuate as Meagan gets paid, as I get paid, as we buy groceries, ect. the Networth is charted as mentioned in a previous blog.

10th- Tenth Step Inventory. Once I have written three things that I did well in the last 24 hours, and 3 things that took me away from God and I don’t want to do again, I write them down. This is my 10th step inventory. My continual personal inventory where if I see that I am wrong, I can promptly admit it and work to fix it, ultimatly reducing my chances of creating a future resentment.

CC- Calendar Check. I check my daily view of my Outlook calendar and print it, if I am in my office.

BP- Blog Post. I strive to post a blog a day.

PC- Podcast. I strive to post a podcast a day.

ABs- 5 mins of abs or core workout. I want to devote at least 5 mins a day to working out my core, specifically my abs.

FB- Facebook post about our company. I like to share a post from our company page once a day. Staying out of the “feed” and not really wasting time with personal stuff. Just helping to spread the word of our company.