11/14/21

Newsletter #5 How do I create an Income Plan? How do I involve my Higher Power in that process?

Income Plans? What are they and how is HP involved in mine?

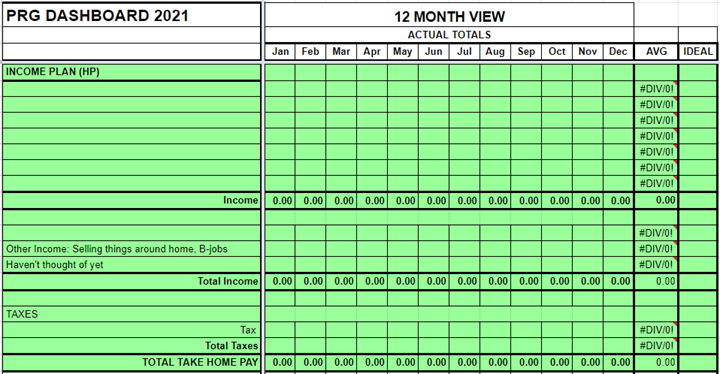

Early on when I was in recovery from debting, under-earning and compulsively spending, I heard someone suggest that the Income Plan corresponds nicely with Steps 1-3. Our Higher Power is chiefly in charge of our income. He told me to put “(HP)” out beside the title ‘Income Plan’ in my spreadsheet. The abbreviated version of steps 1-3 say “I can’t do it, HP can, so I think I’ll let him.” I learned to trust my Higher Power and just take the necessary actions that were suggested to create an income plan for my family. I intend to outline where I am currently with our Income Plan and share some tips and new ideas that I’m learning.

Below in the chart, I created the first set of rows to be for where I can list all the ways that we can earn money over the course of a year. The second section of for “other income”. This is where I put income that is earned from selling items around the house on Craigslist or on Facebook Marketplace. Then, I was told to leave the last line in my income plan open for HP. It was recommended that that last line be for “Things I haven’t thought of yet”. He said, “There will be opportunities or jobs that come my way over the next few weeks and months that I currently have no idea they are coming my way…” and I can look at them as gifts from my Higher Power. They go in the “Haven’t thought of yet” line item of my Income Plan.

When something ‘pops up’ as a chance to earn a few dollars, I can list them in that last line in my Income Plan, in the “things I haven’t thought of yet” line. I have learned to view those income sources as gifts from my Higher Power, which I choose to call God. That income is HP doing for me that which I can’t do for myself.

This chart below is where we put the actual income each month. The averages column is where the preset formula calculates the averages of the month’s income so that we can have a realistic average of how much to expect from that source going forward. Then the last column is for IDEAL Income. This is the best part! This is where I was encouraged to use my creativity and imagination come up with an ideal amount that I would like to earn for each source of income listed in our plan.

What would the perfect world look like regarding income earning from each row? Then finally, we have a section for taxes so that gets taken out per month. Some self-employed people have formulas in there which calculate 25% or 30% of the income so that they can squirrel away that amount of money. Others who are W2 employees simply input the total amount that was taken out of the paychecks for the month from places like Federal, State, Social Security and Medicare. This will leave us with the important number known as “Total Take Home Pay” per month. Take Home Pay is Total Income – Total Taxes = Take Home Pay.

What are B-Jobs? First let’s talk about A-Jobs. A-Jobs are our main sources of income, sometimes referred to as “the 9-5 job” or “the steady, gravy train job”. These jobs are what we can plan on for income. B-Jobs are the ways that we can earn money before and after we get off the A-Jobs. These are also jobs that can be done at night or on the weekends, around our A-job schedules. I thought it might be helpful if I share a few various B-jobs that my partner and I have done over the last few years to earn as supplemental income. These jobs were crucial in allowing us to pay down $68,000+ in active consumer debt in 15 months recently. Those B-Jobs have looked a little like this:

- Gardening work- example, one family needed help building raised garden beds; I got paid to help neighbors with spring and fall clean-ups in their yard. Using my lawn equipment, I helped trim shrubbery, edge beds and even help pull weeds for nice hourly rate.

- Uber & Lyft- I registered our Tahoe for both Uber & Lyft and drove both at peak times during the evenings, weekends and especially during football game nights around our city. Pro-tip: It’s smart to run both apps at the same time to maximize ride opportunities.

- Golf Cart rides- During football games and festivals like Saint Patty’s Day downtown, my daughter and I spent evenings and a few weekends offering rides to people “for tips.” One Saturday night, we made $80 in just a few hours riding wobbly fans up and down a hill in the golfcart helping them get to where they needed to be. Not only was it being of service and making some quick cash, but it was also a fun bonding time with my daughter…Showing her how to do it.

- Airbnb- we stayed a few weekends at my in-law’s house while guest stayed in our home for the weekend. There were homecoming football games and things like parent’s weekend at the university near our home where housing was in high demand. We made great money putting our home up for rent on some select Friday and Saturday nights. As a bonus we got to enjoy a few home-cooked meals and a nice stay at my in-law’s beautiful home on the lake. Easy money.

- Neighborhood Yard Sale- My wife spoke with the president of our neighborhood and helped coordinate a neighborhood wide yard/garage sale held on a Saturday at our park. Everyone brought their items and displayed them nicely. We advertised it in all the local newspapers and a few hundred people stopped by to check it out. It was a big success and we pocketed over $700 that day from junk that we really needed to declutter anyway. The best garage sale apps to advertise on are: Garage Sale Rover, Yard Sale Treasure Map, Garage Sales by Map, Garage Sale Wizards, Garage Sales Tracker, Yard Sale Watch, Private Garage Sale, College Garage Sale & Scrounge Around (http://www.tallysheetapp.com/the-9-best-garage-sale-finder-apps/)

- Sold Household items online- I taught myself how to use the following apps: OfferUp, Ebay, Varage, LetGo and Craigslist. My wife got very efficient at selling on Facebook Marketplace for smaller items. “Front Porch Pickup” worked so well. People would pick up the item that we left on the front porch and tuck the cash under our front mat. Genius! We successfully sold: my old blue guitar from High School, a chainsaw I never used, an old AC Window unit, old tires from a past car that we didn’t have anymore, a mini-fridge from college, a refrigerator in the shed that we rarely used, a 5×10 trailer, my shotgun and rifle from High School hunting days, truck speakers and amp I didn’t need, old radio and speakers from college we didn’t use, a band saw, a few lamps and rugs, crystal glasses we never drank out of…you get the idea. My wife and I noticed items that were just sitting there that we had never used or had not used in the last 6 months, and we decided to turn them into quick cash. Letting go was hard at first, but it has gotten easier over time.

What I’m Learning Now on Income Plans

This weekend I attended Secrets to Successful Living, a 5-part series hosted by Bob Proctor and his team on his YouTube channel. I highly recommend you check it out. You can find it: https://bit.ly/3c94hwL. There were several key takeaways from the training.

- It’s about our attitude if we want to get into “the BIG money”, says Napoleon Hill in Think and Grow Rich.

- He suggested we “Start writing from the paradigm of what you want”. When we write, we are rewriting our program, our new paradigm. Someone else wrote your paradigm that you are currently and were previously living. We must rewrite ours to change the future. Writing creates feelings, feelings create actions, actions change our results.

- Make a decision to become one with what you want, not trying harder to get what you want – we need to have the attitude of the persons we want to become.

- Wayne Dyer said, “When you change the way you look at something, what you look at changes!” Our perception changes. How you look at something is going to change your reality.

- Everything that comes to us in our life we have attracted to us. Everything that has happened in my past has happened to get me where I am today, and for that I am grateful.

- Whatever we send out into the universe, the universe sends right back. That is the Law of Attraction.

- All we must do is to get on the same frequency with the good that we desire. When we do this, it starts to flow to us.

- Make a decision to become one with what you want!

- If you can see it in your mind, then you can hold it in your hand. We have visualized what we want. We need to see a new self-image of what we specifically want. Become one with the good that you desire. We are changing the paradigm. We are determining where we really want to go. We are going to have an attitude of gratitude and we are going to get to where we want to go.

- Control the flow of your thoughts. When we get on the same frequency of money Think and Grow Rich says that it is going to come so fast and furious that you are going to wonder where it was during all those lean years. Most people don’t understand that. Most think that you just must put in ‘more hours’ to get more money.

- The Law of Compensation governs income.

- Focus on the 2nd step of the Law of Compensation. Become a Master at what you do! The people who are the hardest to replace are the people whose stock has gone up… If I continue to get better, the more money I continue to make.

- Turn your annual income into a monthly income. This can be accomplished by having multiple sources of income. Wealthy people have always had multiple sources of income.

Three income earning strategies:

M1: worst strategy in the world for earning and 96% of the people earn this way. This is where we trade time for money. It doesn’t matter what you charge per hour because you always run out of time.

M2: only used by 3% of the population earn this way. This is where we invest money to earn money. You are using your money to make money, but you really must know what you are doing or pay a lot for good advice.

M3: (if you are not on M3, get on it!) only 1% of the population earn this way, however they earn 96% of the money in the world. This is where we become an “Unconscious Competent”, a master in our field, and have multiple sources of income. This 1% of the population earn 96% of all the money in the world because they multiple their time by setting up multiple sources of income. I’m constantly setting up more sources of income. MSI: Multiple Sources of Income.

- Some of these MSIs will earn more and become much larger than other MSIs. Some MSIs may become International sources of income will start coming into our bank accounts after being exchanged from their foreign currency.

- My attitude is the composite of my thoughts, feelings, and my actions. I want to build an attitude that I am prosperous. Desire is the idea that has been planted into the subconscious mind. If you keep feeding the idea, the idea grows. I want you to go after your goals and your big goals financially speaking.

- The money is the most accurate tool for measuring our results. You can measure it to the penny, and you can know if you are progressing or not. Look at your income and if it is not continuously going up and growing, you are not following the laws above properly, says Bob.

- Our income is a direct reflection of our self-identity. How do we see ourselves? How is our self-esteem? If we get resistance with this comment, we attack it with what we want in life. This is about accepting a different idea. Accept that this goal is what I’m going to do no matter what. Your mind’s frequency will switch from why it won’t work, to why it will work.

- Action is what cements the new way of thinking in your life.

Creating an Income Plan. Where to go from here? Action Tips:

- Create a “Win’s Journal”- Add 2-3 wins a day in it. If you keep focused on the wins, you will attract more wins. If you look for the good in thing and situations, you will attract good things and good situations.

- Create an affirmation and repeat it daily for at least 5 mins a day. Really feel it…look into your eyes in front of a mirror. Our eyes are the window of the soul:

“I’m so happy and grateful now that I turned my annual income into my monthly income, and it is great. I’m happy, I’m healthy, and I am wealthy. It is done.”

- “Money is attracted to me.” Say it out loud 10 times in a row in front of the mirror. Money is a servant, and you can do a lot more with it than you can do without it.

- Another Affirmation of the day: “I’m so happy and grateful now that money comes to me through multiple sources on a continual basis. I’m so happy and grateful now that moneys to me through multiple sources on a continual basis…”

- Think of how we can set up MSI’s all over the world so that every one of them flows into your bank account.

- Make a decision on your future, a committed decision. Then give yourself a command and follow it: Discipline.

- Creating a goal card – laminating one goal written on a small business card size piece of paper to be kept in your pocket. The goal has a date on it for when I think the goal will manifest. Yes, the date is just a guess, but the goal is going to happen. If the date comes and I haven’t reached the goal, we are just going to change the date. When we write it on the card, we live like we are already doing it. We write it in present tense and start it with: “I am so happy and grateful now that…” If we keep acting like we’ve got it, it must appear based on the laws we discussed above. I must expect the goal to happen.

- Write out 50 times in present tense the amount of money that you intend to earn like this: “I’m so happy and grateful now that I’m making $______ a year and I love it.”

- “Money is attracted to me.” Own that statement.

Final Thoughts

“You are most powerfully positioned to serve the person you once were.” Rory Vaden’s TedTalk https://www.youtube.com/watch?v=y2X7c9TUQJ8

In case you missed last week’s newsletter on Analysis of Two Debt Repayment Methods – Newsletter #4

If I can ever help you in any way, please let me know. Feel free to share this with anyone who might find it beneficial. Hope you have a wonderful week and remember….as mama always says, “Make your contribution!”

Matt Warren

803.240.0717