To create a 100-year generational wealth plan for your family, consider the following steps:

- Start with a purpose: Determine your goals and the opportunities you want to provide for your family members.

- Make financial literacy a family value: Encourage open discussions about money and educate your family members on financial management.

- Diversify your investment portfolio: Spread your wealth across various asset classes to minimize risk and maximize returns.

- Consider life insurance: Life insurance can provide financial stability for your family in the event of your passing.

- Start a college fund: Save for your children’s education to give them a head start in life.

- Create an estate plan: Document your wishes for the distribution of your assets and ensure that your plan is reviewed regularly.

- Build your financial team: Assemble a team of professionals, such as financial advisors, estate planning attorneys, and accountants, to help you achieve your wealth planning goals.

- Embrace the next generation: Actively involve your children and grandchildren in the family’s financial matters, fostering trust and transparency.

- Hold regular family meetings: Schedule quarterly or semiannual meetings to discuss the family’s vision for wealth and share financial knowledge.

- Invest in private businesses and real estate: Diversify your wealth by investing in private businesses and real estate, which can provide long-term growth and stability.

- Teach responsibility and values: Instill in your family members the importance of financial responsibility and the values that guide your wealth planning.

By following these steps and maintaining open communication with your family, you can create a lasting generational wealth plan that will benefit your family for years to come.

To ensure that your family members are financially literate, consider the following steps:

- Talk about money openly and often: Make financial discussions a regular part of your family conversations, and avoid treating money as a taboo topic.

- Start early: Introduce financial concepts to children at a young age, and build on their understanding as they grow older3.

- Involve your family in financial decisions: Encourage your family members to participate in household financial decisions, such as budgeting and saving.

- Use real-life examples: Share personal financial experiences, both positive and negative, to help your family members learn from your successes and mistakes.

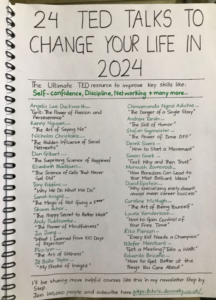

- Leverage resources: Utilize available resources, such as podcasts, books, and websites, to teach your family members about financial management.

- Set up a family bank account: Consider opening a kid-friendly bank account for your children, and involve them in the process of managing the account.

- Encourage saving and budgeting: Teach your family members the importance of saving and budgeting, and provide them with tools and resources to help them develop these skills.

- Discuss long-term financial goals: Talk about the importance of setting financial goals and planning for the future, such as saving for college or retirement.

- Teach investing: Introduce your family members to the concept of investing and help them understand the risks and rewards associated with different investment options.

- Promote financial responsibility: Encourage your family members to take responsibility for their financial decisions and actions, and emphasize the importance of learning from their mistakes.

By incorporating these steps into your family’s routine, you can foster a strong foundation of financial literacy and help your family members develop the skills necessary to manage their finances effectively.