In the last email, I wrote about Developing an Income Plan. Today, I’d like to share what I’m learning, and it has to do with “read the numbers.”

Recently, I was working with a fellow who has not yet taken the action step of putting his numbers into a Daily Spending Plan spreadsheet. We were talking last night, and I told him “I don’t mind getting your number in the text format that you send me, but I can’t do anything with them…I can’t read the numbers.” He didn’t quite know what I meant so I thought this is a wonderful opportunity to explain.

During that call, I told him that I was going to write my next newsletter about what it means to “read the numbers.”

An audiobook that I’ve been absorbing recently is Rich Dad Poor Dad by Robert Kiyosaki. I read it many years ago, but something is different today being that I’m hearing the great content with solvent ears this time.

One key thing that I heard was how Robert’s rich dad told him when he was a kid that he must learn to read the numbers.

Reading the numbers means being able to interpret a few scenarios like:

· Income this month is up by 20% compared to my average monthly income, thanks to my B-Job.

· Spending on “out-to-eat” is down compared to recent months and groceries are up, because we have been cooking more at home and not eating at as many restaurants.

· The savings account for our prudent reserve is three months of our average expenses and growing.

· My spending plan requires that I need to earn on average _X_ amount of money in income to not debt or have to pull from prudent reserves.

DO APPS KEEP MY NUMBERS FOR ME?

Sometimes people use apps to keep their numbers, thinking that is a timesaver or “the modern way of record keeping.” The problems I found with apps (like Mint.com or Everydollar app… which I have tried both before) is that I got frustrated when I was trying to “read the numbers”.

I was inputting and categorizing all my numbers into the apps, but:

- I couldn’t chart or graph the data.

- I couldn’t put in formulas to take averages or to add up special categories or groupings, if needed.

- I couldn’t arrange the data to be custom to my situation which limited my abilities.

- I couldn’t color code cells or highlight areas that I needed to go back and double check.

- I couldn’t add notes into the cells to help me remember important details about a transaction.

Sometimes people just text themselves their numbers in a giant text format. This is good in that they have started the process of record keeping and tracking their income and spending…but you can’t do anything with the numbers. They are practically impossible to read.

My experience has been that those numbers must be put into an Excel or Google Sheets spreadsheet or something like Quicken or QuickBooks to be able to get any value from them and to understand what they are trying to tell us.

The benefit from taking the action is that:

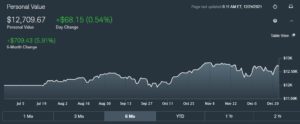

1) We can see trends.

2) We can see averages.

3) We can see if things are going in the right direction or not.

4) We can read the numbers and decide if certain behaviors or activities need to be adjusted or eliminated based on what the numbers are telling us.

5) We also can see the relationship between our Income Statement as it relates to our Balance Sheet…AKA: Income and Spending Plans as they relate to our Personal Financial Statement.

What do I mean by that?

I mean that we can start to get clarity over vagueness in how much we are spending on self-care and expenses. Once we know the total expenses per month, we can then use that number to reference our Assets on the Balance Sheet or Personal Finance Statement.

How much income per month do our assets generate? (Example: real estate, businesses where we are not needed, stocks, investments, rental properties)

Do we need to invest into more assets that generate more passive income?

Do we have enough assets that generate passive income to offset our monthly expenses?

Remember Net Worth = Assets minus Liabilities. Assets grow our net worth and liabilities take away from our net worth.

Hope you found this beneficial. Thanks for letting me share.

Have a wonderful Thanksgiving!

Matt